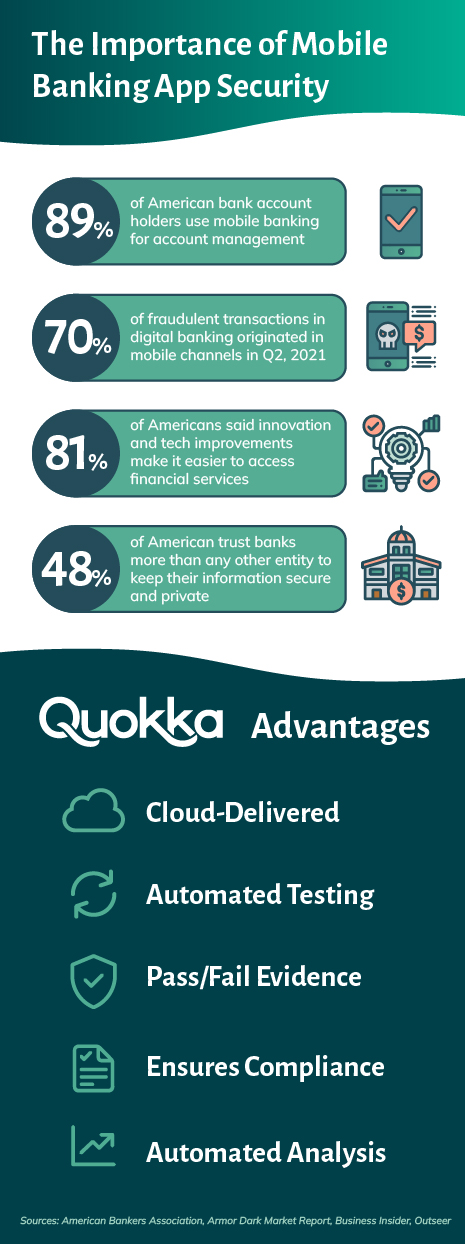

Financial institutions now have greater access than ever to their customers. With over seven thousand bank and finance apps being downloaded every second in 2020 and as more customers adopt digital-only banking practices, the threat of mishandling data increases. With bank branches closing due to the pandemic, more people found that they liked the convenience of mobile banking, in fact, 89% of American bank account holders use mobile banking for account management. But are banking apps a secure way to handle your finances?

If you use a mobile banking app, be aware that security threats exist everywhere. The top three threats for financial apps are banking trojans and malware, fake banking apps, and data leakage. Mobile application security should be a priority for fintech companies and financial institutions, and it can be safe as long as banks and consumers take certain precautions.

Quokka’s Mobile Application Security Testing solution, Q-MAST, uses military-grade technology and incorporates the most rigorous testing standards in the world. Quokka scans all in-house or 3rd party deployed apps on your mobile phone estate. Automatically identify mobile app vulnerabilities while respecting the privacy of every user and maintaining compliance standards.